REALTOR® Commissions Explained

There’s a lot of misconceptions about REALTOR® commissions… how it’s so easy to get rich selling real estate & how overpaid REALTORS® are. We’re here to share the facts so you can make informed opinions vs. ones based on hearsay.

WATCH THIS WEEK’S EPISODE OF

THE GENUINE REALTOR® SHOW

OR READ ON FOR THE BLOG

Let’s get real for a moment.

There is a VERY real reason the majority of people who get their license drop off in or before their second year… it’s not as easy as the rumours make it look!

The figure that’s often quoted is that 87% of agents change professions within the first 2 years. Of those REALTORS® who do stick it out, the majority do less than 2 deals a year.

So no. Being a REALTOR® is anything but easy money however, we’re not going to deep dive into what it takes to be successful in real estate here.

We are going to focus on where the commission you pay your REALTOR® goes.

Before I dive in, I do want to point out a few important things…

- REALTORS® take on a lot of risk when listing a home… We are paying the upfront costs for marketing & put in a lot of hours with absolutely no guarantee we will be paid. REALTORS® only make money when our client successfully buys or sells.

- We work a lot. In fact, we work almost every night & most weekends. Even holidays aren’t safe from clients having questions or wanting to see something. Also note, being in a personal relationship with a REALTOR® is strenuous at best.

- Personal safety risks are real. We regularly meet strangers in homes & this can put us in compromising situations.

- Also, there are a lot of legal liabilities we take on in this profession. We need to be well versed in homes we’ve never lived in & are liable for the information we provide the public.

All of this to say, being a REALTOR® is no walk in the park & we work very hard for the commission we do get to take home.

And on that note… let’s cover the commission structure.

The majority of the time, all of the REALTORS® in a transaction are paid by the Seller’s.

It’s been this way for decades & in rare circumstances, the buyer may be responsible to pay, but if that were ever the case your REALTOR® would let you know.

So again, when you buy, you’re not responsible for the commission but when you sell, you are.

Next, let’s cover the blanket legalities…

There is no such thing as a set commission in Ontario, or Canada for that matter.

The Competition Act has outlined that REALTORS® are not allowed to collude on commissions. This means we cannot price fix or cooperate with each other to only charge a “set rate”.

What does this mean for you?

It means that commissions are negotiable & that you can almost always find a company who structure their remuneration in a way that works for you.

Years ago, 6% or 7% was common.

Then 5% became the recurring percentage… now we have commission models that go as low as .5% or even a one-time payment.

Just as the commission costs fluctuate, so do the services provided.

Someone who is charging you a one time fee of a few thousand dollars can’t offer the same services as someone who markets your home with a few thousand of their own money upfront in pre-list preparations.

The point is, a REALTOR® may have an office policy on what commission they charge but ultimately you need to focus on the services provided & how it will fit into your goals as well as impact your day to day life.

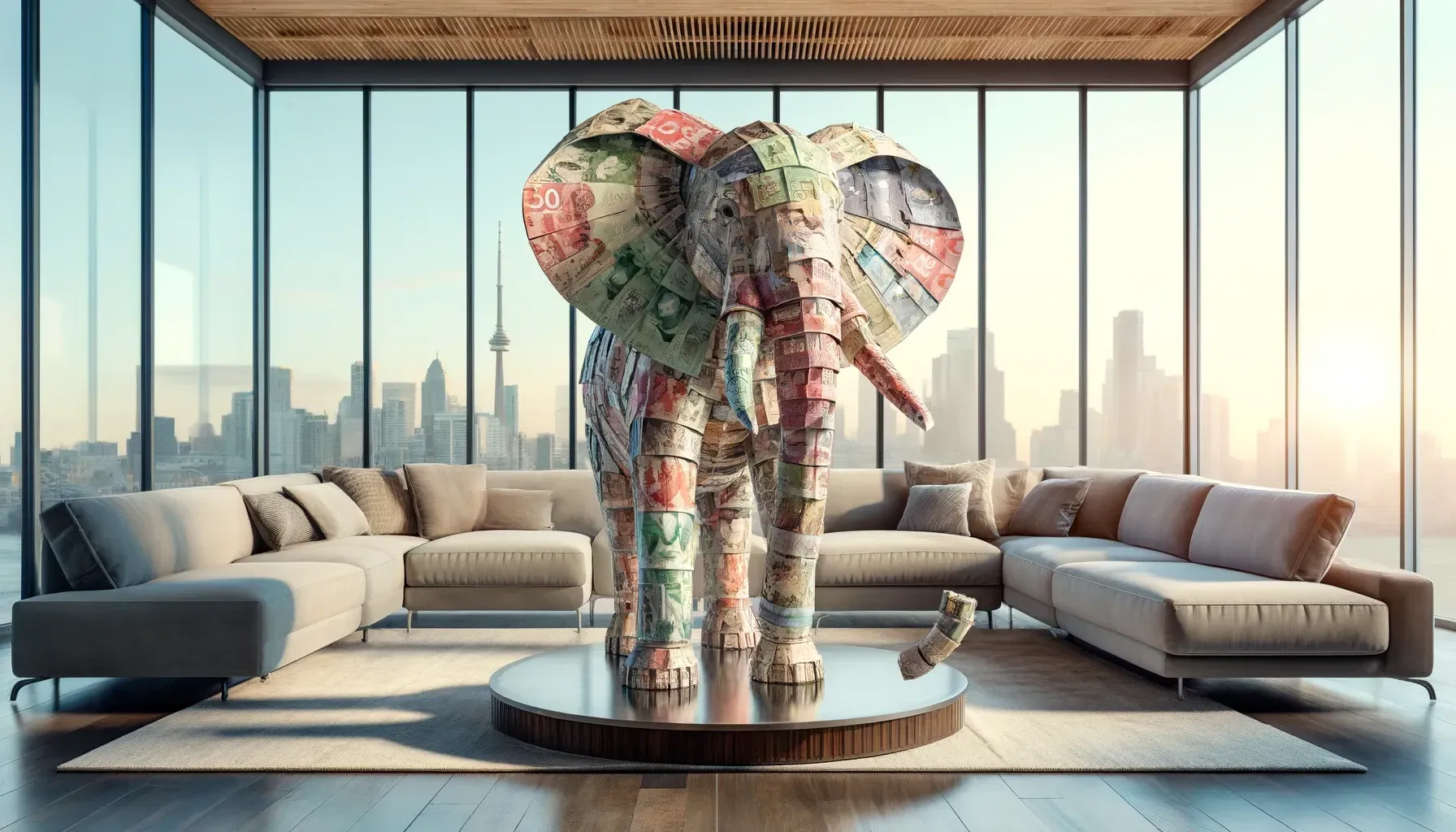

So now, let’s look at a 5% commission breakdown on a $500,000 sale.

The total commission payable would be $25,000 + HST.

Yes, real estate services are all HST applicable so definitely account for that when budgeting your sale!

Right off the top, 50% is going to the co-operating brokerage… that is, the REALTOR® representing the Buyer in the transaction.

From the remaining 50%, or $12,500 that the Listing REALTOR® is working with… they will have a commission split set up with their Brokerage. This can range anywhere from a specific transaction fee all the way up to 50% of their commission.

Since this is my video, I’ll go with my commission split which is 25% to my Brokerage.

Next up is the income tax. For the REALTORS® who are masters of their business, they could be paying as much as 50% of their income to the Canadian Revenue Agency since their income bracket dictates the percentage paid to CRA. For this breakdown, let’s go with 30% to cover us mere mortal REALTORS®.

Of the remaining $6,575, we have our standard pre-list & marketing expenses. These are things like staging consultations, photography, drone footage, videography, staging expenses, on-going advertisements, etc). Typically we spend $1,000 – $2,500 depending on the size of the home & what it needs to be market-ready.

Next, we take operating expenses into account of $1,500 – $2,000 . These are things like administration costs, pulling title inquires, MPAC reports, Real Estate Licensing fees, liability insurance, vehicle & gas expenses, auto insurance, communication expenses, just to name a few.

So what are we left with?

The net income for a $500,000 sale price with a 5% commission structure would be around $3,075.

Yes, selling is expensive. But assuming your REALTOR® is raking in the big bucks is a stretch at best.

Now, when it comes to commission-based sales, obviously the more expensive your home is, the more a REALTOR® makes but the costs associated with marketing & selling your home likely don’t increase at the same rate. So it is absolutely fair to work together to find a commission structure that works for everyone or you may not be the right fit for each other & that’s totally fine!

If you’re still here with me, thank you!

This was definitely a lot to cover & I appreciate you taking the time.

If you’re thinking about buying or selling, reach out!

We’d love to help you or connect you with a trusted REALTOR® from our network if you’re not in our area.

Until next time,

Keep it Genuine!

The Genuine Blog