Going to the Chapel? • Know Your Real Estate Options •

Planning a wedding?

You should probably read this.

Congratulations on your upcoming nuptials! This is such an exciting time & a whirlwind of planning, celebrating & lots of advice from those we love.

Between fittings & tastings we fit in invitations & decor planning — but have you been considering your Real Estate plans?

Many couples hurry to the altar as they see it as the first step in a life style sequence that has been the norm for centuries. But as we all know, the 21st century is vastly different from the world our parents & grand parents grew up in.

We have options beyond the “set in stone” story line of our lives — it’s a good idea to open the dialogue about home ownership & figure out what option is best for your lives specifically.

Last weekend I was enjoying a wonderful housewarming for a client when a mutual acquaintance shared their recent experience buying a home. After listening to his story unfold I felt compelled to share their experience with all of you because they just didn’t know their options!

This lesson is one that I wish their REALTOR® had thought to mention as the cost of the wedding coupled with the cost of buying a home was a lot & any savings would have been wonderful!

Finding out after that they could have saved thousands was really difficult to swallow.

This story begins many years ago when these love birds were still dating and the Mr. wisely decided to invest in his first home. As time passed the two grew closer & the Mrs. said yes to the Mr.

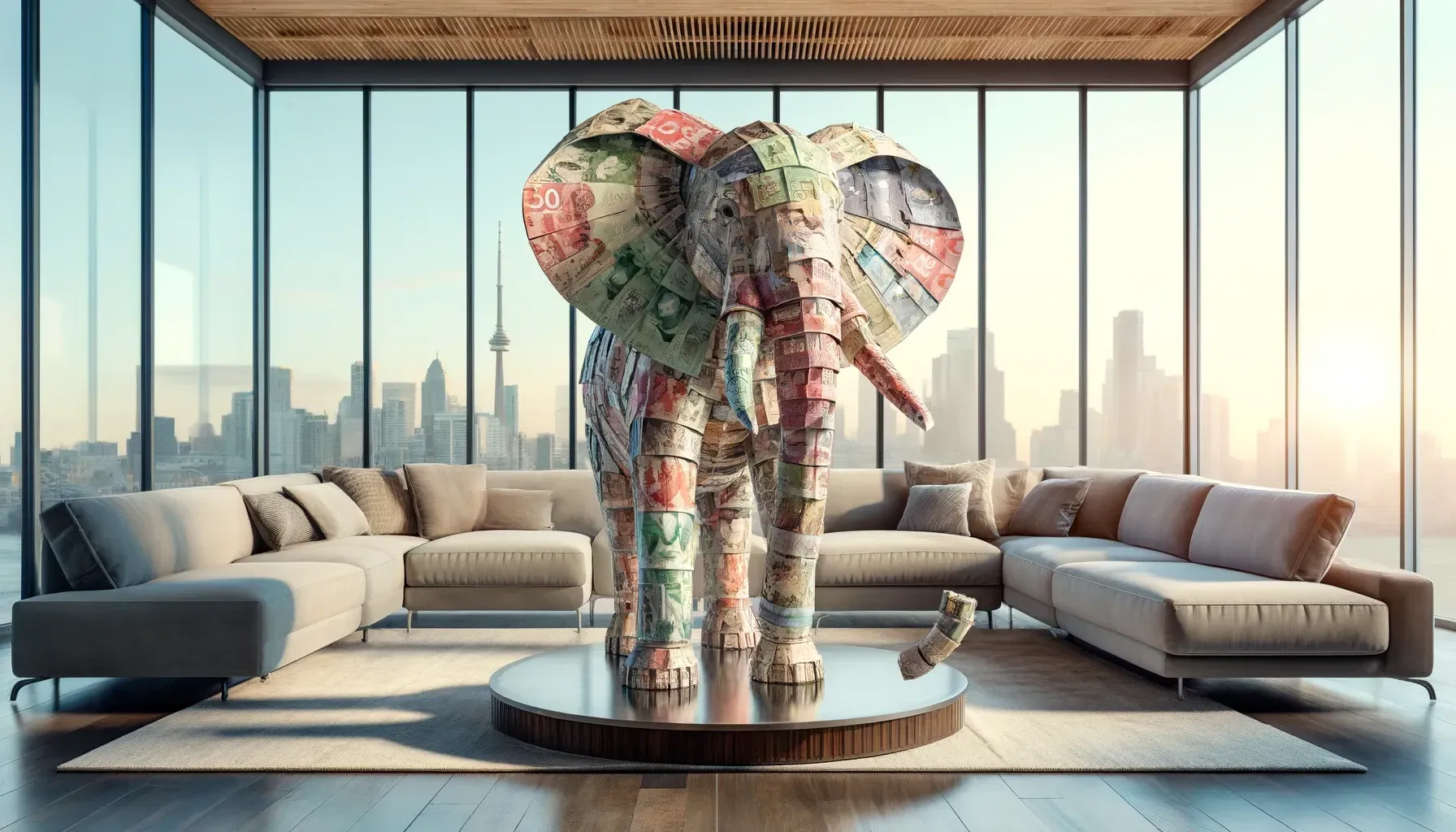

A beautiful wedding was celebrated & memories made followed by a compromise on where they would start their newest chapter together. But at closing they find out that getting married forfeited the Mrs’ First Time Home Buyer exemption.

This essentially cost them $4,000 as that is the amount they would have been reimbursed had they bought the house before getting married.

Now take a moment to really think about how far that $4,000 could have gone —

A bathroom reno?

New appliances?

An amazing honeymoon?

Getting your life started as a couple has never been as expensive as it is today… every dollar counts & I really wish I had been representing them so I could have educated them on their options. They may have still chosen the same path but at least it would have been a choice they made with all options presented & considered.

Every time you transfer the title of land into your name within Ontario you will need to pay a Land Transfer Tax.

This tax scales depending on the cost of your purchase & if you are purchasing in the City of Toronto you will have a second municipal land transfer tax (essentially doubling the cost). People who have not purchased a home or had an interest in a property are eligible for a rebate of up to $4,000.

(On January 1st of 2017 the exemption was increased from a maximum of $2,000 to a $4,000 maximum rebate on land transfer tax.)

If you choose to live together for more than 3 years prior to buying a home or if you get married & then purchase a home, you forfeit your right to that refund. That’s $4,000 that, depending on your circumstances, could stay in your pocket.

Want to figure out what your best course of action is? Give us a call or text…

we would love to help you figure out your best next move!

We serve Hamilton-Wentworth, Halton & have a wonderful network of

talented REALTORS® if you are looking outside of our areas of expertise.

Keeping it Genuine,

The Edwards Team

of S. Todd Real Estate

Ltd., Brokerage

The Genuine Blog